Rolling down Jingdong smoothly, why is the capital market waiting to see Pinduoduo?

Recently, Pinduoduo's stock price hit a record high. This news took turns on the major mainstream technology websites. In Thursday's trading, Pinduoduo shares rose 12.56% to close at 39.96 US dollars, with a market value of 46.448 billion US dollars, becoming China's fourth largest Internet company, second only to Alibaba, Tencent and the US Mission. This time, the stock price rose, and once again, Pinduoduo surpassed Jingdong and won the second position of e-commerce. This year is a year of exuberance for Pinduoduo. Not only is the overall stock price particularly bright, but it has also received buy-in ratings from many well-known venture capital institutions. According to the results of the previous two quarters of financial reports, the growth rate of various core data is still more than Ali and JD. This further strengthens its position in the e-commerce industry.

After Ali and Jingdong have been entrenched in the e-commerce industry for many years, the upstart Pinduoduo has gained a firm foothold in the sinking market with the thunder of lightning, and has opened a new breakthrough in the e-commerce industry with the social e-commerce model, and it is still very high. The growth rate has also increased the expectations of the outside world. This stock price rose to a record high, and once again shows that Pinduoduo's business model is recognized by the capital market. What magical power does it attract investors? Although the high stock price of Pinduoduo boosted confidence, can it continue to maintain a stable upward trend in the future like Ali?

Pinduoduo realized the three times beyond the core data of Jingdong has completely hanged Jingdong

In the past two years, users who used Pinduoduo were considered by the outside world to be “great and cheap”, but today, the fast-growing Pinduoduo has successfully captured the hearts of 400 million users. "I used to ignore it, I can't afford it today." This sentence may not be exaggerated when used on Pinduoduo. The price of Pinduoduo reached a record high, and the market value once again surpassed Jingdong. It further proved to the outside world that it has the strength to stabilize the e-commerce position in the e-commerce industry. Previously, Pinduoduo's development goal was to catch up with Jingdong, but now it seems that Pinduoduo's goal seems to have been achieved. According to the current data, it has already had enough strength to prove that it is the e-commerce second.

In terms of user scale, Pinduoduo gradually opened up the gap between active users and JD. Last year, when Pinduoduo went public in the US, its user scale was already approaching Jingdong. At that time, the outside world was still questioning the speed of Pinduoduo's catch-up. According to the first financial report released by Pinduoduo, it was the first in terms of active users. Beyond. In the Q4 quarter of 2018, the annual number of active buyers of the Pinduoduo platform reached 418.5 million, an increase of 173.7 million from 2017's 244.8 million, a year-on-year increase of 71%. In the Q1 quarter of 2019, as of the end of March, the number of active buyers of the platform reached 443.3 million, an increase of over 50% over the same period last year. As of June 30, in terms of annual active users, Pinduoduo surpassed Jingdong as the second largest e-commerce platform after Ali in China with a size of 483.2 million.

According to Jingdong's active users, as of June 30, 2019, Jingdong's active users in the past 12 months increased to 321.3 million, and in the second quarter, the number of active users increased to 10.8 million. In the first quarter of 2019, the number of new users was 500. More than ten thousand. In terms of active users, the current Pinduoduo has exceeded the Jingdong 160 million scale, and the surpassing of this core data has become the key to Pinduoduo's second position in e-commerce. In terms of GMV, Pinduoduo Huang Wei revealed in his internal speech: Pinduoduo's latest quarterly real payment GMV has exceeded Jingdong.

In this data, Pinduoduo has been performing a fabulous growth rate. Pinduoduo has become China's third largest e-commerce platform (calculated by GMV) in only three years. In September 2016, the number of Pinduoduo users was only 100 million, and the monthly GMV (commodity sales) was only 1 billion yuan; however, in January 2017, Pinduoduo's monthly GMV exceeded 4 billion yuan. In 2018, Pinduoduo's GMV exceeded 471.6 billion. According to the data of the Q2 financial report of the three companies in 2019, Pinduoduo's operating income increased by 169% year-on-year. In the past year, the GMV (commodity transaction total) increased by 170.5% year-on-year to reach 709.1 billion yuan. In the second quarter, Ali and Jingdong did not disclose. The scale of GMV, but according to their data last year, Jingdong's 2018 GMV was 1.7 trillion yuan. According to Pinduoduo, the scale of the first half of this year exceeded 709.1 billion. In fact, the gap between it and Jingdong is indeed getting closer.

Pinduoduo's share price and market value have caught up with Jingdong, this data is the most intuitive. As of the end of the article, Pinduoduo's share price is 39.96 US dollars, the market value is 46.448 billion US dollars; Jingdong's stock price is 30.72 US dollars, the market value is 44.17 billion, Pinduoduo has exceeded JD.com nearly 1.6 billion US dollars. From the comparison of these core data, Pinduoduo still hangs Jingdong in any aspect, so it is indeed right enough to sit on the second position of e-commerce. Why is Pinduoduo's share price so high? What is the point of breaking out of its business model? Pinduoduo business model is now huge growth potential, upside development space is recognized by investors

Previously, based on the release of bedrock capital and snowball data, the "2019 US stocks in the third quarter of the list", although the stocks in the third quarter fell more and more, but the overall downturn is difficult to cover up the stocks, the e-commerce giants Pinduoduo pressured Jingdong and Ali, and rose to the top of the list of rising companies. Why is Pinduoduo able to attract more investors in the capital market?

Pinduoduo has an absolute competitive advantage in the sinking market, and the market has huge consumption potential. In the sinking market, the competitive advantage of Pinduoduo is still very obvious. On July 23, QuestMobile, the domestic authoritative data company, released the China Mobile Internet semi-annual report. The report showed that after the “cat fight dog” e-commerce war, Pinduoduo saw a net increase of 72.2 million in the sinking market in June, a year-on-year increase of 59.4. %, ranking first in the e-commerce first network.

In the e-commerce industry, the user base in the sinking market has become the fastest growing group. The consumer potential of this market is huge. Pinduoduo has established a firm foothold in the low-price mode. In the future, it still has a high level in this market. The growth rate. According to the data from QuestMobile's sinking market report, as of March 2019, the number of users in the sinking market has exceeded 600 million, accounting for more than half of the total mobile Internet users in China, and the per capita usage time is longer than non-sinking users. The usage time has exceeded 5 hours and the growth has been faster. Second, Pinduoduo came out of a different road from Ali and Jingdong, and went to the centralized mode to make it more favorable to customers.

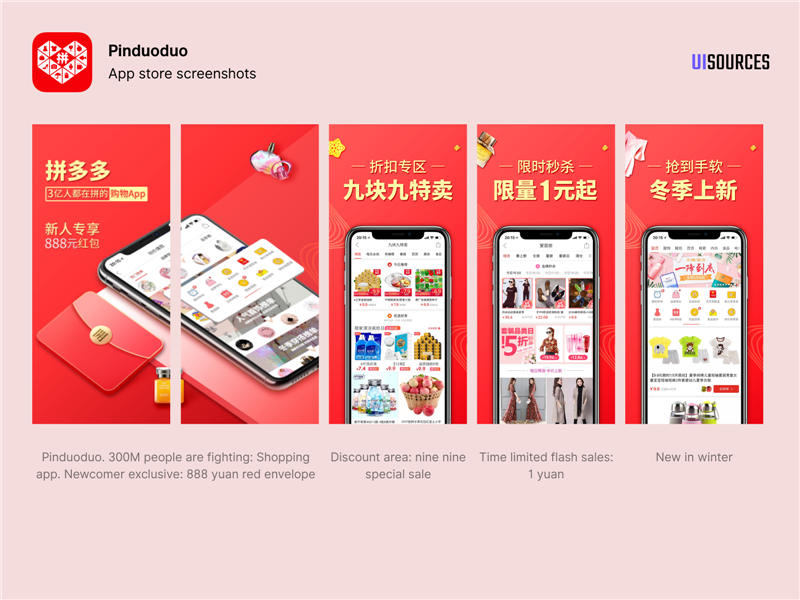

All along, Ali and JD. have divided most of the market share in the e-commerce industry, which makes it difficult for other incomees to have the opportunity to seize their market. With the social e-commerce model, Pinduoduo opened a way out in the sinking market with a decentralized business model. In the early stage, this will help Pinduoduo avoid the positive competition with Ali and JD, so that it can quickly acquire users with WeChat acquaintances. This has also become an important milestone for Pinduoduo in the sinking market. As we all know, Pinduoduo's innovative business model is the key to its foothold in the industry. It activates a large number of incremental demand and new consumer channels, including the second and third-tier cities where e-commerce is not yet smooth, especially one. The batch does not often visit the middle-aged and old-age consumer groups in Taobao. For example, Pinduoduo captured a large number of consumers in third- and fourth-tier cities in a short period of time through a “1 yuan to win the treasure” and other grouping modes. Because the group gathers the crowd, the same thing gathers faster and the tail is less.

Third, Pinduoduo gradually embarked on the rural encircled city, from the bottom up to penetrate the first and second line market. After Pinduoduo achieved great success in the sinking market, it was not only satisfied with the sinking market. It adopted the strategy of encircling the city in the countryside and began to counterattack the first- and second-tier markets. The agricultural products and the subsidized iphone were the two sharp knives of the Pinduoduo counterattack. According to the data released by the National Bureau of Statistics on July 31, the number of young users aged 16-35 accounts for 83% of Pinduoduo users, and 44% of Pinduoduo's new users come from first- and second-tier cities. The proportion of first- and second-line users and penetration rate are increasing. This will further increase the profitability of Pinduoduo, because the low price is attractive to consumers regardless of the city.

For Pinduoduo, it can penetrate into the first- and second-tier cities to show that its platform influence is improving in these big cities, and the users of this market are also reversing the direction of Pinduoduo's public opinion, which is mainly due to Pinduoduo Plus. Great investment in the quality control of the goods, to minimize the problem of fake goods on the platform. At present, the growth of many new users of Pinduoduo comes from this market. From the bottom up, it also proves that Pinduoduo's business model is feasible and will have some impact on Ali's impact. Fourth, Pinduoduo wants to become "Costco+Disney", pushing the C2M model to expand its position in agricultural products.

In the past, Huang Wei said that Pinduoduo is going to be Disney + Costco. The implication is that it wants Pinduoduo to be a cheap and interesting platform for selling products. Judging from the follow-up actions of Pinduoduo, its measures of 10 billion subsidies, new brand plans, and agricultural products are all available to consumers to buy good quality products at "cheap" prices. At the same time, a lot of orchards, limited time spikes and other play methods, also make consumers addicted to shopping fun. Many people think that Pinduoduo's success lies in the group, the products are sold cheaply, although they are right, but the core of it is the C2M business model behind its products, which is an unprecedented business model of the Internet, but also an investment. The point that should be the most concerned. From the supplier's point of view, the C2M model allows suppliers to plan large-scale production, reducing the corresponding fixed costs, especially for fruit and agricultural products, because no one wants it when it expires.

As Pinduoduo increases its layout for C2M, especially in agricultural products, it is further expanding, which will help Pinduoduo to establish a stronger competitiveness in this product category. At present, Pinduoduo is gradually improving the user's shopping experience, and the variety of products on the platform is further expanding. Its C2M model still has potential for its tremendous development momentum. The surge in stock prices boosts Pinduoduo's confidence, but the follow-up is also facing great challenges. This Pinduoduo's share price can achieve such a large increase, and indeed it will further stimulate Pinduoduo's stock price performance in the future, but this situation should be treated rationally. At present, there are still many problems in the development of Pinduoduo. If it can not handle these risks in the future, it is likely to affect its future stock price trend. First, Ali and Jingdong force sinking market, Pinduoduo is threatened to increase

In the first half of this year, e-commerce giants Ali and Jingdong all put down their bodies and pointed to the sinking market. Both Ali restarted and cost-effective, and Jingdong's comprehensive bet on the purchase business. The 2019Q2 financial report shows that the two heads in the e-commerce sector are protected from the decline in domestic retail sales growth, but the shift in business focus is a little bit, and their battle with Pinduoduo in the sinking market will be more intense. Ali and Jingdong both ploughed down the sinking market on the basis of their greatest advantages, and quickly attracted a large number of users. For Pinduoduo, it will encounter a strong attack from Ali and Jingdong in the next, and want to maintain the market share. It will be even more daunting.

Second, Pinduoduo is still in a loss stage, and the failure to achieve profitability will be questioned by the market. From the perspective of capital markets, although many investment banking institutions such as Nomura Securities, Goldman Sachs Bank and Barclays Bank have expressed optimism about Pinduoduo, they are interested in their future potential. Once they cannot maintain high growth rate and cannot achieve profitability, they will inevitably Being questioned led to a correction in market value. In the second quarter, Pinduoduo's net loss was 1.0033 billion yuan. At present, it is still implementing a loss subsidy model to increase the user's repurchase rate. Once Ali and Jingdong operate like this, Pinduoduo's follow-up will face higher costs. Third, Pinduoduo is very difficult to move from bottom to top, and the attraction of capturing first- and second-tier cities is not enough.

For Pinduoduo, although it has a lot of user growth in first-tier cities, we can see that this part of the user growth is not very easy. On the one hand, Ali and Jingdong are still the first choice for consumers in this market. Platform, on the other hand, in terms of product categories, Pinduoduo is still in the downside of brand products. For users in first- and second-tier cities, they purchase products that value brand quality and types. Pinduoduo needs to further expand its products in this respect. Competitiveness. On the occasion of the double 11 coming, Pinduoduo's stock price can achieve such a high increase, or it can stimulate more investors to trust it. For Pinduoduo, whether it can achieve higher record in this e-commerce war. It will be related to its financial results in the next quarter. For Pinduoduo, catching up with Jingdong proves that its business model is promising, but whether it can challenge Ali's position is also waiting to be seen. Can it achieve such a transcendence? The US stock research society will continue to pay attention.

More market value surpasses Jingdong, and the second place in e-commerce is more intense.

The double eleven e-commerce wars have not yet started, and many of them have been preemptively boosted by the capital market. On October 24th, the share price of the company increased by 12.56%, the highest intraday price reached 40 US dollars, and the final closing price was 39.96 US dollars. At the same time, the total market value of 46.4 billion US dollars has also made the company more than the Jingdong, becoming the fourth-highest Internet listed company in China, the top three are Ali, Tencent and the US Mission. Previously, according to the public's "LatePost" report, many founders Huang Wei said at the mobilization meeting of the company's four-year anniversary that the actual payment of GMV has exceeded JD.

In the second quarter of the financial report, as of June 30, the total number of GMVs reached 709.1 billion yuan, an increase of 171% year-on-year; the annual active buyers reached 438 million, a growth rate of 41%. Both are significantly higher than Ali and JD. Starting from sinking the market, there are many fights, and they are also actively entering the "five rings." Judging from the current various subsidy actions, the company is still in the stage of traffic expansion. The real test of many spells may be after the number of users reaches the ceiling.