Xiaomi Breakout Battle: Two years to invest in the layout and killing of 12 supply chain companies, how many cards does Lei Jun have?

The first-hand ecological chain and the first-hand supply chain have built Xiaomi's investment breakthrough tactics in both product business and technical strength. On October 11th, the release of Xiaomi Refrigerator complemented its market puzzles in TV, air conditioners, washing machines and refrigerators – “four major pieces of home appliances”. Looking back, in 2019, it is the sixth year of the eco-chain layout of Xiaomi. In the past six years, Xiaomi's ecological chain has grown wildly and relied on its own supply chain advantages and sales channels. It has penetrated into more than 200 fields, including smart home, daily necessities, wearables and travel. Among them, there are Huamei Technology, a wearable device manufacturer that has successfully listed in the US, and Yunmi Technology, a smart home company. Last year, Zhiwu carried out a deep dismantling of 95 companies from the perspectives of Xiaomi's ecological chain, such as style of play, explosive thinking, data contribution and responsible person structure, showing the difficulties and worries faced by Xiaomi's ecological chain.

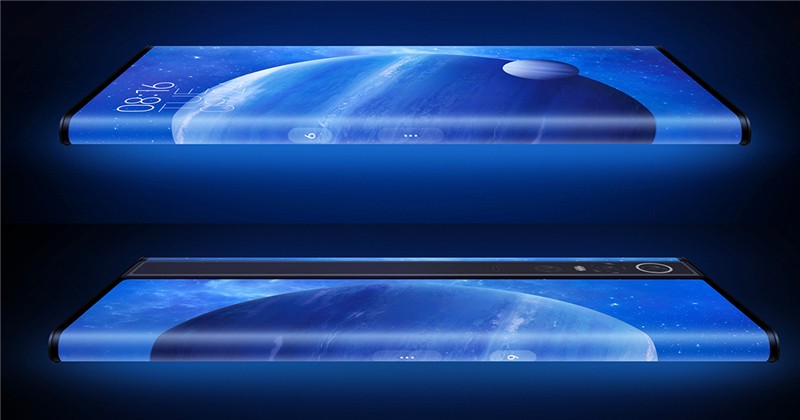

Since its establishment in 2010, Xiaomi has gone through nine years, and it has been more than a year since it was listed on the Hong Kong Stock Exchange. However, when the old-fashioned topic of "Millet is an Internet company or a home appliance company" is still controversial, its latest quarterly earnings report has led public opinion to a new entanglement. According to Xiaomi's second quarter financial report for 2019, as of June 30, 2019, it had more than 270 investment companies with a total book value of 28.7 billion yuan, a year-on-year increase of 20.8%. At the same time, as of August 20, it has invested in 12 supply chain companies, of which 3 have been listed on the Kechuang board. For a time, the voice of whether Xiaomi wants to become an investment company has risen, and the 12 supply chain companies have also become the focus of the industry. Although the "ecological chain" and the "supply chain" are the difference between the two words, but the Xiaomi investment ambition is different, if the play of the Xiaomi ecological chain has made the "millet grocery shop" wherever it goes, the upstream core Investment in supply chain companies or technology companies indicates that Xiaomi is committed to strengthening the supply chain's voice and building a technological foundation. Although, Xiaomi did not say who they are, but the wisdom of things through a multi-party combing and in-depth investigation, which listed three companies should not escape Jingchen shares, Lexin Technology and Fangbang Electronics.

As for the remaining 9 companies, Zhishi further combed the relevant investment of Xiaomi Group within two years. After analysis, it was initially determined that it should be among the following 10 companies. It is not difficult to see that while continuing to build the eco-chain map, Xiaomi has not forgotten another investment battlefield outside the “bamboo forest” and extended its coverage to supply chain companies. That is to say, the current Xiaomi is taking the investment path in two directions, one is the ecological chain, which is biased towards product category investment; the other is the supply chain, which is biased towards technology investment. This time, Zhizhi will focus on the investment strategy of Xiaomi's supply chain. Through in-depth investigation, it is explored whether this is a "trial jump" in Xiaomi's current supply chain market. Are the companies favored by Xiaomi the new weapon that Xiaomi has helped to build the future supply chain empire? What will they bring to Xiaomi? Although it seems that Xiaomi's supply chain investment is not as exciting as the previous story, it can still glimpse Lei Jun's core technology of Xiaomi and some thoughts and actions in the upstream and downstream market competition.

The technical weakness, increase R & D investment and supply chain to save

For a long time, Xiaomi's biggest hardship is the lack of self-developed technical skills. From the perspective of smart phone business, the production of Xiaomi mobile phone relies on OEM, hardware and software can only rely on procurement. Although the Pengpai S1 chip was launched in 2017, the subsequent Pengpai S2 is “born” or “dead” and there is no news. From the perspective of IoT business, as early as 2014, Xiaomi's product line has begun to show the thinking of Lei Jun's layout of IoT, and gradually enriched and developed. At this stage, Xiaomi smart wear and travel equipment is mainly in the form of deep cooperation, brand empowerment and channel resources. So where is the advantage of Xiaomi? "Value for money."

It is undeniable that Xiaomi's “5%” profit red line has indeed “killed” a market in the market with low price advantage and marketing strategy. However, with the domestic smartphone camp's Huawei, OPPO, vivo, the IoT camp's market expansion of big players such as Alibaba, Baidu and Tencent, and the new players who smell the market cake, Xiaomi wants to occupy a considerable long-term. Market share must have a core self-developed technology card. In 2017, Xiaomi's R&D investment was 3.151 billion, accounting for 2.75% of total revenue. From the horizontal comparison of rivals in the same period, Apple's R&D investment accounted for about 5.1% of total revenue, Samsung's 6.4%, and Huawei's 15%. Time to push back, Xiaomi's research and development expenditure in the second quarter of 2019 was about 1.556 billion yuan, a decrease of 5.7% from the previous month and an increase of 14.1%. In this quarter, Xiaomi's revenue was 52 billion yuan, and R&D investment accounted for 3.08%.

It can be seen that Xiaomi is indeed stepping up investment in technology research and development to enhance the hard power of self-developed technology. After all, it has positioned itself as "an innovative technology company focused on high-end smartphones, Internet TV and smart home ecosystem building." At the moment, Xiaomi wants to become an "innovative technology company", and it is really difficult to rely on self-development. From this point of view, the choice to open up a new model of supply chain investment is also in line with Lei Jun's consistent routine of sweeping the market and snapping up the company while building the ecological chain. So then, what is the difference between Xiaomi's supply chain investment “battlefield” and eco-chain investment? On the one hand, Xiaomi has established a relationship between procurement and supply by investing in eco-chain enterprises, and provides corresponding resources and channels to lay out the layout in many smart equipment fields and gradually infiltrate the smart products of Mijia terminal. To the various markets of IoT. For example, the No. 9 robot, one of its eco-chain companies, together with Xiaomi, built the Mijia electric scooter and laid a marketing channel on Xiaomi's specialty store.

On the other hand, it invests in the supply chain to make up for the shortcomings of its own technical hard power shortage, not only to obtain the raw materials and capacity resources of these enterprises, but also to provide protection for their own product supply chain. Indeed, the current millet needs to exert strength, not only to maintain the "Jiangshan", and gradually expand the surrounding business, but also continue to increase the cost of research and development, using technological innovation to break the bottleneck of research and development of independent technology. This time, Xiaomi seems to be imperative.

3 boarded the science and technology board, accounting for 3.16% in Jingchen

Two years ago, Xiaomi set up the Xiaomi Industry Fund to deeply participate in the manufacturing industry, open up its layout in industrial investment, and said that it would build a BAT for Chinese manufacturing. Two years later, Lei Jun said at the Chongqing Zhibo Conference at the end of August this year that Xiaomi has expanded its investment supply chain to the smart manufacturing and semiconductor chip industries in the past two years. Of the 12 companies currently invested, 3 have succeeded. Listed on the Science and Technology Board. It is not difficult to see that since the opening of the board of science and technology on June 13, the scale of China's capital market has entered a new stage. At the same time, financing has continued, and a number of areas covering semiconductors, electronic equipment and medicine have also been born. Advanced entrepreneurial players, worth rising overnight. In this crazy game of capital, 30 companies have been listed on the science and technology board so far, opening up new battlefields. Among them, Jingchen, Lexin Technology and Fangbang Electronics, which successfully boarded the board, are all Xiaomi Investment Company.

It is worth mentioning that Xiaomi holds the highest number of shares in Jingchen shares, which is 12.99.75 million, and holds (circulated) shares as 3.16%. What attracted the attention of Xiaomi? In fact, this has long been associated with the slaughter of Xiaomi in the IoT field. There are two main types of investment in Xiaomi, one is strategic investment based on Xiaomi ecological chain, and the other is industrial investment based on Xiaomi fund. The Jingchen shares, which was established in 2003, is one of the levers that Xiaomi tried to use to invest in the industry to expand the IoT business map and incite social capital. Jing Chen focuses on the development of multimedia intelligent terminal application processor chips. Simply put, it provides chips for smart set-top boxes, smart TVs and AI audio and video system terminals.

In terms of technology, the smart set-top box and smart TV chip developed by the company adopt 12nm process technology, and have high-definition ultra-high definition decoding, high dynamic picture processing, and iterative image quality processing engine. At the same time, the AI TV series chip with embedded neural network processor is also a focus of its development. Based on these technological advantages, companies such as Xiaomi, Alibaba, Baidu, Google and Amazon have become customers of Jingchen. Among them, Xiaomi is one of the company's top five major customers. In 2018, Jing Chen's sales to Xiaomi amounted to approximately RMB 262 million, accounting for 11.06% of the same period, including Xiaomi's related electronic products and communication technology. Based on this partnership and Xiaomi's IoT strategy, Xiaomi's investment will naturally come naturally.

According to the prospectus, on November 2, 2018, Jingchen signed a "share transfer agreement" with Xiaomei, a wholly-owned subsidiary of Xiaomi. Jingchen transferred its 3.51% stake in the issuer to People Better, the price per share. 1.93 US dollars. The latter became the sixth largest shareholder of Jingchen. Interestingly, the actual controller of Zhichen's discovery of Jingchen shares is a couple, both of whom are masters of electrical engineering at Georgia Tech. Husband John Zhong Chinese name Zhong Peifeng, holding 28.02%, wife Yiping Chen Zhong holding 4.41%, while the latter's father Chen Haitao, through Cowin Group and Peak Regal holding 9.68% and 16.34% respectively. In other words, the couple and the father-in-law together hold a 58.45% stake in Jingchen. What does the family holding more than half of the crystal holdings bring to Xiaomi? As of September 9, the closing price of Jingchen shares was 91.73 yuan / share, and People Better held a stock market value of 1.192 billion yuan. In addition to the shareholder relationship, Jingchen's semiconductor technology in the field of multimedia intelligent terminals has become one of the important weapons for Xiaomi to expand its territory in the IoT field. At the same time, this is also a profile of Xiaomi's desire to "resurrect" the semiconductor "core" battlefield and carry out in-depth cooperation with upstream chip companies to improve the overall competitiveness of the company.

Two years to invest in 8 semiconductor companies, for research and development Pengpai S2 power

What is the "core" battlefield pattern of Xiaomi? In February 2017, Xiaomi brought the first self-developed chip Pengpai S1, becoming the fourth self-developed chip mobile phone manufacturer after Apple, Samsung and Huawei. For a time, Xiaomi earned enough volume with the Pengpai S1, a performance-ready terminal chip. However, one year later, the next generation of S2 chips has almost no audio. Is the millet chip "dead"? It is not necessarily true. In April of this year, Xiaomi split pinecone into Songguo and Nanjing Big Fish Semiconductor Co., the former continued to develop mobile phone SoC and AI chips, while the latter focused on AI and IoT chip and solution research, and independently financed. This step coincides with Lei Jun's official announcement of Xiaomi's “Mobile + AIOT” dual-engine strategy at the beginning of this year. At the same time, Lei Jun also promised to invest 10 billion RMB in the AIOT field in the next five years. This is undoubtedly an important decision for Xiaomi to try to break through the shortcomings of technology development.

Xiaomi also knows that it is far from enough to build a self-research team. Investment naturally becomes the only way for the company to “resurrection” the chip business. According to statistics from the intelligence, in less than two years, Xiaomi has invested in eight semiconductor companies. In addition to Jingchen shares and Lexin Technology have been listed on the Science and Technology Board, VeriSilicon Microelectronics is also promoting the process of listing the science and technology board. In July this year, Xiaomi took a stake in two semiconductor companies, Core Microelectronics and Hengxuan Technology. Among them, Xiaomi holds 27,188,000 shares of Weiyuan Microelectronics, holding approximately 6.25% of the shares, and is the fourth largest shareholder of Weiyuan Microelectronics. Founded in 2001, VeriSilicon Microelectronics is a platform-based chip design service provider with R&D centers covering China and the United States. R&D chips cover mobile internet devices, data centers, IoT, wearable devices and smart homes. And with Huawei, Apple and Microsoft and other technology giants have a cooperative relationship. At the same time, the predecessor of VeriSilicon Microelectronics is inextricably linked to Celestry Design Technologies. This has to mention Dai Weimin, the founder of Weiyuan Microelectronics. His sister Dai Weili is the co-founder of Marvell, and his brother Dai Weijin is the president and CEO of Vivante.

Dai Weimin, who graduated from the Department of Electronic Engineering at the University of California at Berkeley, is also not a simple. He was the founding chairman of the IEEE Multi-Chip Module Conference and the founding chairman of the IEEE IC/Package Design Integration Workshop.

In 1995, he founded Ultima, a computer-aided design high-tech company that was acquired by Berkeley Technologies in 2001 and renamed Celestry Design Technologies. Dai Weimin is co-chairman and chief technology officer, and Hu Zhengming, one of the founders of Berkeley Technology, is the father of the famous FinFet. With the idea of being sold to the US company Cadence for $135 million, one of the company's divisions was stripped and became today's core microelectronics. What are the advantages of the core microelectronics? Obviously, the company's powerful semiconductor technology gene is undoubtedly one of the important reasons why it can gain a foothold in the current chip battle and attract Xiaomi investment. At present, the company is also further increasing the research and development efforts of AI chips to break through the bottleneck of the self-developed AI chips at this stage. In response to this investment, some insiders said that Core Microelectronics will bring more technical and computing support to Xiaomi's chip, and also enable the chip to have NPU processing capability.

Xiaomi's core-making road is tortuous. After experiencing the difficulties of chip development, slow process and technical team restructuring, how to solve the shortcomings of insufficient technical ability is what it has been working hard. The eight semiconductor companies invested by Xiaomi, in the short run, are one of the investment tactics for inputting peripheral technologies to solve the bottleneck of self-developed chip technology; in the long run, this is also the impact of Xiaomi's upstream chip development market. The chain layout is an important step in unlocking the potential of the current chip battle in our country.

Guangsha network intelligent manufacturing industry, the main attack robot

Lei Jun is another piece of cake for Xiaomi's investment supply chain, which is in the smart manufacturing industry. How big is this cake? Zhizhi combed and analyzed the relevant investment involved in Xiaomi for two years, and selected a list of 12 supply chain enterprises that are more likely to invest in Xiaomi, related to smart manufacturing enterprises. Including the listed Fangbang Electronics, a total of five intelligent manufacturing enterprises, involving robots and high-end electronic materials manufacturing in two major areas, Xiaomi holding more than 7 million shares. Among them, the IPO process of Chuangxin Laser is currently in a state of suspension. It is understood that the main reason is that the company's inventory accounts for more than 50% of the current assets, and more than 20% of the profits come from subsidies. In addition, before the listing, Chuangxin Laser had a number of performances on gambling, listing and gambling agreements, and many have triggered. However, in the course of the inquiry of the Shanghai Stock Exchange, the company stated that there is no investment agreement to be liquidated, and it will not adversely affect the stability of the issuer's controlling interest. So, how does Chuangxin Laser attract the favor of Xiaomi?

According to the prospectus, Xiaomi obtained the shares of Chuangxin Laser in January and February through share transfer, which cost a total of 112 million yuan. Up to now, Xiaomi holds 3.266 million shares of Chuangxin Laser, and its shareholding ratio is about 4.43%. As the vanguard of domestic fiber lasers, Chuangxin Laser's main revenues from 2016 to 2018 were 411 million yuan, 586 million yuan and 693 million yuan respectively, and the compound annual growth rate of revenue was 29.36%. Among them, the company's two major product lines are pulsed fiber lasers and continuous fiber lasers. In fact, in the current laser field, more and more companies are plunging into the competition in the fiber laser market. In terms of technology, the technical bottlenecks and thresholds of medium and high power fiber lasers have basically broken through, greatly stimulating the transformation of old players and the entry of new players. More importantly, the current fiber laser market is not yet saturated, and a large piece of cake is still waiting to be eaten. Then, in the environment where domestic fiber laser enterprises are everywhere, what are the advantages of Chuangxin laser?

According to the "2019 China Laser Industry Development Report" data, Chuangxin Laser currently ranks second in the domestic market, with a domestic market share of 12.3%.

It is not denied that the ventures including Chuangxin Laser want to open up and attack the ambitions of the domestic robot and intelligent manufacturing market. They have the appetite of Xiaomi, not only harvested the big customer of Xiaomi, but also got the money and marketing of Xiaomi. Support for resources and other aspects. It is not difficult to see that in the face of the steady growth of the robot and intelligent manufacturing market, as well as the new opportunities for the development of AI technology and the promotion of 5G communication technology, Xiaomi's investment in these enterprises is undoubtedly an important layout for the construction of the Xiaomi supply chain. One. Cheng, Xiaomi can also successfully open the key to a market dividend door; defeat, Xiaomi may still have more backhand for this "battle" blood. After all, Xiaomi's ambition to become a “national enterprise” is even greater.

Conclusion: The breakthrough of Xiaomi's two-way investment strategy

The first-hand ecological chain and the first-hand supply chain have built Xiaomi's investment breakthrough tactics in both product business and technical strength. Especially in the current IoT fragmentation market, and the trend of 5G communication technology gradually commercialization, the opening of Xiaomi's supply chain investment is undoubtedly a power and attempt to seize market opportunities. As Xiaomi CFO Zhou said, Xiaomi hopes to lay out a strong Chinese supply chain ecology. Two years of investment in 12 supply chain companies, from semiconductor coverage to intelligent manufacturing, this is not only the foundation of Xiaomi's "mobile +AIoT" dual-engine strategy, but also its new breakthrough on the basis of building an ecological chain.

However, this breakout will be a long and protracted battle. Xiaomi wants to get through the entire upstream and downstream market and get the right to speak. The effort is not enough. The problems it faces at present, in addition to the heavy responsibility of "resurrection" Pengpai chips, there are self-study technical shortcomings, immature organizational management structure, low IoT eco-chain market penetration rate, and a slumping share price. Layout, killing, breakout, in this turbulent market, Xiaomi holds the capital and IP cards in one hand, and holds the ecological chain and supply chain chess that has not really seen up in the first hand. Can it be re-started from this protracted war? Kill a bloody road? Moreover, can Xiaomi's tight supply chain investment really bring technological innovation to Xiaomi? Or is it only like Apple that chooses M&A technology companies to truly achieve technological breakthroughs? All these answers let time come to verify for us.